[ad_1]

Are you bored with working customary conventional monetary merchandise presents, and need to check out one thing new?

The Finance vertical is rather more numerous than you suppose! There’s a contemporary and hyped path referred to as Crypto-Backed Loans, and it’s gaining traction.

So, in case you are not conversant in crypto mortgage presents but, right here is all the things we learn about them—in a really reader-friendly Q&A format!

When contemplating crypto loans, it’s vital to make use of solely authentic and controlled providers that adjust to monetary legal guidelines. At all times verify if the platform is registered with a acknowledged authority and follows procedures.

What’s Flawed With Conventional Loans?

Nothing, in actual fact. There are many lending firms which can be able to pay affiliate entrepreneurs for leads and shoppers. They’ve varied CPA presents for various visitors varieties, and good sufficient payouts. Nonetheless, hitting conversions on this vertical is getting tougher with time.

Serge Abramov, media purchaser:

It’s tougher to face out amongst tons of opponents and make customers convert if you run typical mortgage presents. Sure, coming into this area of interest is comparatively straightforward: you could find a suggestion with prepared creatives and tips in a minute. Nonetheless, scaling is hard as a result of leads are exhausting to amass — the market is oversaturated, and many individuals submit a number of mortgage functions.

In the meantime, the crypto lending trade has some important benefits:

- Typically, affiliate entrepreneurs and media patrons can get payouts in crypto

- Crypto mortgage presents can have increased conversion charges as a result of the applying course of is less complicated

- It’s a completely new trade on hype, that pursuits rich sufficient customers from Web3

- Associates can earn ongoing commissions whereas the applying of a person stays energetic

What are Crypto Loans?

Crypto loans enable folks to borrow money or stablecoins by locking up their cryptocurrency as collateral. Briefly, it really works like this – on the instance of borrowing USDT backed by Bitcoin:

- You point out how a lot you should borrow in USDT

- You see the sum of your collateral – you’ll be able to take not more than a sure proportion of the collateral quantity, often, it varies between 70%-80%

- You verify the mortgage curiosity – often, you’re charged hourly or every day

- You pay out the mortgage inside the requested timeframe

Nonetheless, folks can lose their collateral in the event that they don’t repay. Additionally, if the collateral’s worth drops too critically, a lender can diversify the mortgage to cowl the debt.

Though it sounds easy, this observe has many nuances. For instance, the viewers for these loans is sort of particular: it’s unlikely that your grandma will take part, even after the top-notch kitten advert inventive.

Who’s the Crypto Loans Viewers?

To reply this query, we requested one other one: why do folks take crypto loans in any respect? It turns on the market are 4 important causes to do it, which evolve into the 4 crypto loans viewers varieties:

- Skilled crypto traders. The crypto market can unexpectedly surge. So if you happen to want fiat {dollars} however don’t need to merely promote your Bitcoin for them, what if it loses worth in the meantime? – You possibly can borrow these {dollars} and depart your Bitcoin as it’s. That’s how crypto traders generally handle their funds. In addition to, there are some particular buying and selling methods with crypto loans.

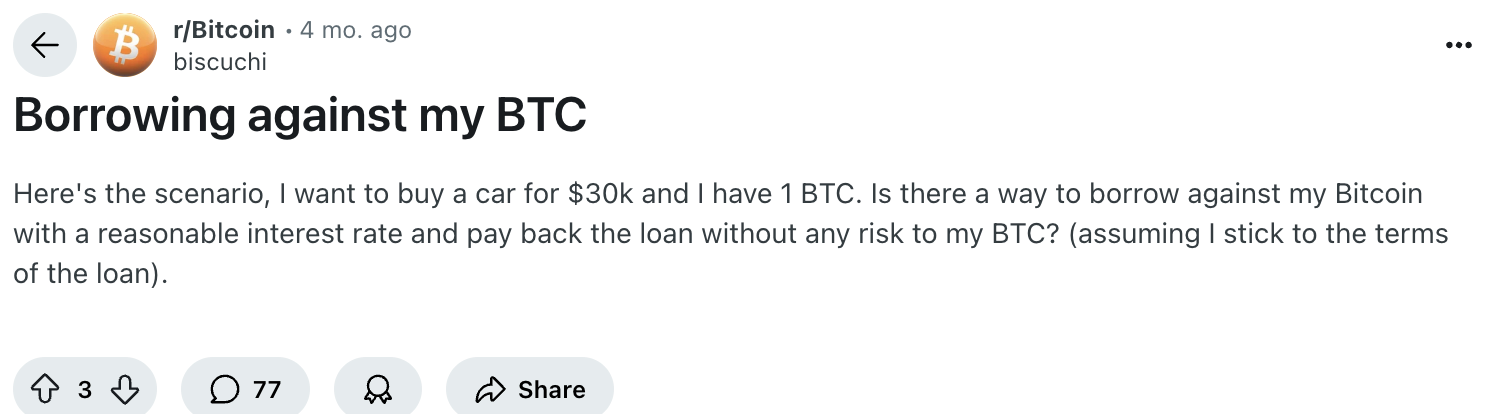

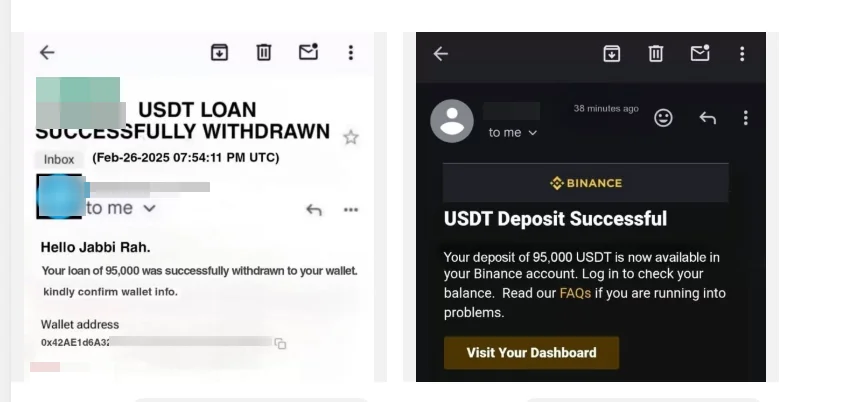

- Crypto holders. This sort isn’t into buying and selling a lot, however they know the character of blockchain and seek for some new methods to revenue from their crypto property with out promoting them. In addition to, there will be some uncommon objectives, like this:

So, though the viewers is slender sufficient, it’s fairly clear who you’ll primarily goal: folks holding crypto property, who need to make investments and commerce their currencies.

The place and The way to Promote Crypto Mortgage Presents?

There’s not a lot distinction between crypto loans and conventional loans when it comes to funnels. Nonetheless, you should do not forget that the viewers is particular sufficient. So you want a visitors supply filled with people who find themselves considering Web3, or those that need to study extra about it.

In addition to, the subject of crypto lending might sound difficult even for individuals who are conversant in blockchain tech. Your funnel would possibly embrace some instructional moments to develop a greater understanding and belief within the merchandise: it may be video explainers, articles, or free PDF guides.

So, the place and how will you discover the visitors you want?

Telegram

The primary possibility is Telegram, a messenger and social community with many providers for crypto lovers, together with an in-house crypto pockets.

You possibly can promote on Telegram with three strategies:

- Native adverts on Telegram channels associated to crypto or buying and selling on the whole;

- Advertisements in Mini Apps through advert platforms

- Telegram official adverts that additionally seem in channels and will let you goal folks by pursuits

We defined the distinction between these three varieties on this article:

And listed below are some inventive examples (these are for official Telegram Advertisements):

Fb

Fb lets you goal folks by pursuits, too, so why not really do it? Any of your acquainted Fb advert creatives and funnels will do: for instance, you’ll be able to publish a Reels video with a small textual content and CTA.

Listed here are some examples:

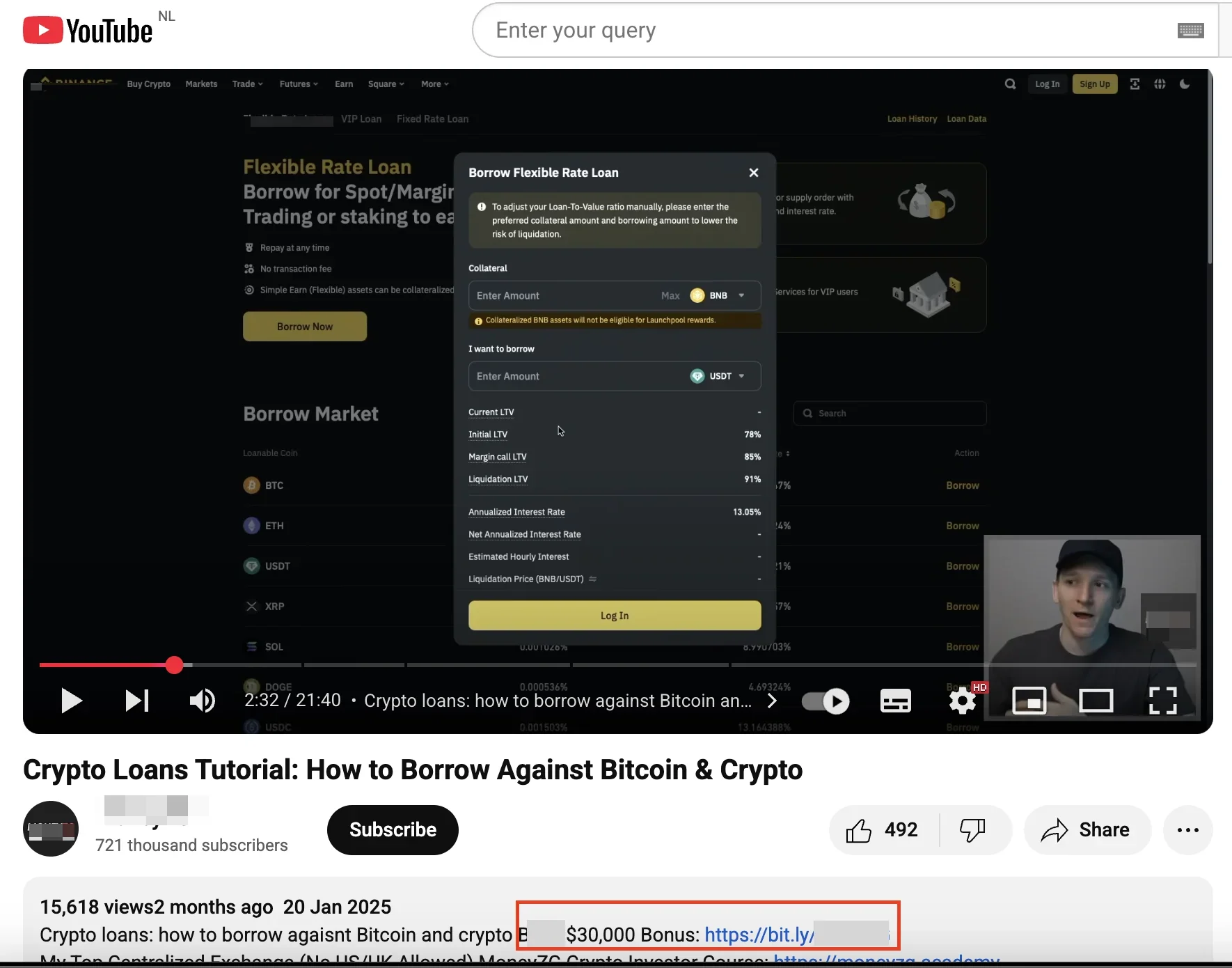

YouTube

Right here we’re primarily talking crypto influencers who’re prepared to teach folks on crypto merchandise, and promote loans on the identical time. YouTube is stuffed with explainers the place respectful and standard merchants educate folks on crypto mortgage merchandise very clearly and in quite simple phrases. Normally, they do it by utilizing examples from varied platforms. And sure, these video descriptions predictably include hyperlinks to those platforms. So, they principally handhold customers in direction of merchandise.

After all, that is extra about direct partnerships with crypto loans affiliate packages than selling CPA presents as an affiliate marketer.

Blogs and Boards

This will embrace articles in varied listicles on crypto-related platforms – one thing like ‘What’s the greatest crypto lending provide’ or “Crypto lending presents defined’.

Picture supply: screenshot from https://coinledger.io/

In addition to, Reddit, Quora, and different boards typically have discussions the place folks ask about one of the best crypto mortgage platforms.

The place to Discover Crypto Mortgage Presents?

Nothing too difficult right here once more: similar to with most verticals, you’ll be able to verify CPA networks or direct affiliate packages.

Listed here are some provide examples (we don’t identify the manufacturers resulting from our insurance policies):

| Microlending firm for crypto-backed loans – CPA + RevShare: [Desk+Mob] [EU] | 9 EUR per lead, 1,8% from every mortgage taken |

| Crypto dealer with a mortgage provide | RevShare, 0.2% month-to-month on every energetic mortgage |

| Crypto dealer with a mortgage provide | RevShare, 10% of the month-to-month curiosity from a person’s mortgage |

To Sum Up, Is It Perspective or Not?

It appears that evidently sure, it’s. The crypto trade retains rising, and extra Web2 viewers is moving into the blockchain providers and merchandise.

With such a rising demand, crypto mortgage providers will maintain providing aggressive payouts to media patrons, affiliate entrepreneurs, and influencers.

That stated, the vertical would possibly nonetheless stay fairly area of interest and particular, with a really explicit viewers of crypto traders and merchants.

Be a part of our Telegram for extra insights and share your concepts with fellow-affiliates!

[ad_2]

Supply hyperlink